Alternative Investment Opportunities in a Downward Housing Market

29 September 2016 (Updated 11 December 2016)

Short leases, lower ground floor flats, bank owned property sales, commercial to residential conversions, and self-builds could prove profitable as housing market slows and buyers' market ensues.

A downward or subdued housing market can present opportunities for investors. With the pool of buyers limited, the scope to negotiate increases. Most investors scout for deep discounts or fire sales in the market. However, there are other strategies that investors or homebuyers might use to profit in a slow housing market.

See also: Blog - Top Tips for Pitching Low Offers

See Also: London Sales Rack - Deepest discounts across London

Short Leases

Buying a property with a short lease is effectively a way of delaying payment of the entire purchase to a later date. Buyers typically pay a purchase price compatible with the time remaining on the lease. Then, at a later date, an extension could be purchased that is reflective of the market value of the property –minus the time left on the lease. If a buyer views the market as continuing to move downward, they could wait for prices to drop further then trigger the negotiations for the extension. Therefore, in short, the buyer has limited their capital losses. However, if the market rises between the purchase and the request for the lease extension, the buyer would not enjoy the full capital appreciation of the value of the property as they are purchasing the extension at the current market value.

As Jonathan Turner, a senior associate solicitor specialising in conveyancing and lease extensions at Charles Russell Speechlys LLP highlights: "Certainly, if a downturn in property values is expected, then the purchase of a property with a short lease, with a view to applying for a lease extension once the market has fallen, may well be profitable."

Interestingly, many holders of short leases choose to extend their leases in a down market in an attempt to reduce costs for the extension. Those choosing to sell instead may be individuals not able to afford the extension or wishing to simply "move on". Therefore, it could be that there is a higher probability of these sellers being motivated to accept offers on the property.

Turner states "Generally, a depressed housing market can often lead to an increase in enfranchisement claims. This is not only due to the kinder property values, but because owners may not be willing or able to move, they instead decide to invest further in the property that they already own. That may be by way of improvements or, indeed, increasing the length of their leases."

In most cases, there is little arbitrage opportunity when purchasing a lease extension. That is to say, the lease extension value is based on pre-set formulas and any negotiating on the extension price is subject to the discretion of the freeholder. If an investor is lucky enough to find a freeholder who needs to free-up capital, they may be willing to negotiate in order to raise money quickly. Alternatively, if the purchase price of the property is substantially under market value, then the investment could pay off.

Buyers should be ready to pay in cash as many lenders have constraints on the number of years remaining in a leasehold.

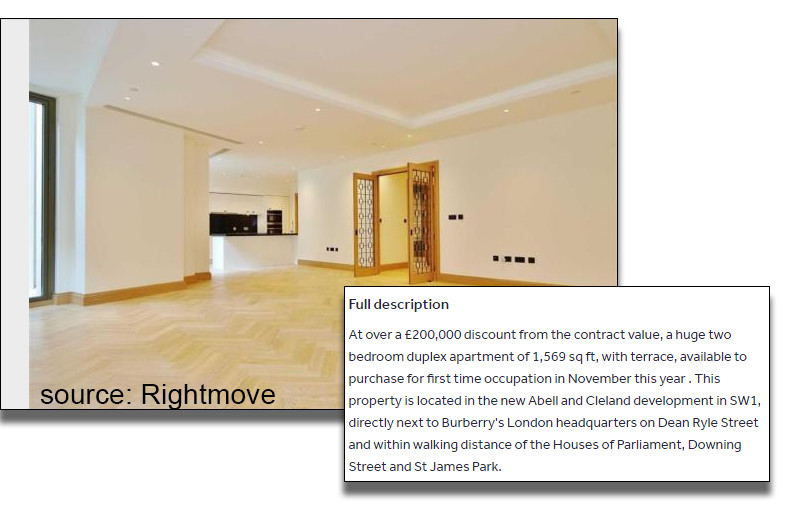

In Pimlico, SW1, within this new Abell and Cleland development sits a Ground and Lower Ground floor duplex listed for £1,163 per square foot. - 33pct less than upper floor units. Vendor appears willing to sell under contract value.

Lower Ground Floor Flats

In many areas of Kensington, Chelsea and Westminster, lower ground floors are priced up to 45pct less than upper floors within the same building or area. With prices already down in these Prime Central London locations, it now means that some lower-ground floor properties are listed at the same level as many areas outside of the Prime Central London perimeter.

Restricted views, ground-level noise, reduced light, and temperature all affect marketability of lower ground floors. Cultural factors are also at play as many foreign buyers simply refuse to consider a lower-ground flat.

In the past, the price difference between lower ground and upper level flats was between 15pct-20pct. Now, in some Prime Central London locations, its common to find flats discounted of upwards of 30pct.

With reduced number of buyers, price gaps between upper and lower floors widened as sellers compete for attention. Discounts on lower ground floor flats attempt to draw buyers away from more desirable upper levels.

Some investors specifically seek lower ground flats in prime areas in order to mine for value. Rental yields for lower ground floor flats tend to be higher than upper floors whilst capital growth generally follows the housing index in the area.

As with many trends, the gap between the pricing of lower ground floors may fall back into line with historical patterns. For now, many shrewd buyers may decide that a great location combined with value for money offset any drawbacks. With many new builds offering high-quality sound and heat insulation alongside quality finishes, it may be a good time to consider a lower ground floor in these developments.

Conversions, Extensions, and Developing

Scope to extend or development opportunities are popular amongst investors in a rising market. The premise is straight-forward: by the time the development work is complete, a potential profit could be made on the extra space along with any rise in the housing market.

With uncertain housing forecasts, investors or small homebuilders may prefer to sell any remaining stock instead of risking exposure to house price drops. In areas rich in home extensions, such Clapham, Kensington, Chelsea, and Hammersmith and Fulham, properties having scope to improve are appearing more frequently on the market. This could indicate small, independent builders are sitting on the sidelines until signs of a stronger market emerge. This effectively clears the path for homeowners looking to secure a property where they can add value.

In a slow market, a reduced pool of buyers could mean "opportunity". Securing a property at a price reflective of the state of the property and having the "optionality" of doing the work later could be an attractive prospect for those buyers with a growing family.

Change of Use from Commercial to Residential

Some investors have been tempted by the seemingly low asking prices of commercial units with the hopes of converting into residential. It is important to note that consent by the council must be obtained for conversion into residential. In the meantime, the buyer is exposed to business rates on the property along with the uncertainty that residential approval will be granted. If financing is required, the buyer would have to secure a more-costly commercial loan instead of a residential loan.

Investors should weigh up the risks and costs before proceeding. If risks are reduced and the price is right, this could prove to be a good move.

Bank Foreclosures

Properties owned by banks as a result of a foreclosure could offer a profitable opportunity. Typically banks have more flexibility in settling for a low price than a private vendor. With a subdued housing market, it may prove difficult for foreclosure sales to attract the necessary pool of buyers so as to lift the price of the property. Given that a very low offer is highly unlikely to insult a bank and banks have little incentive to hold a residential property on their books, it may be worth a punt.

However, be aware that most banks require the estate agent to advertise the highest offer on the property. There is a high probability that another buyer will materialise and gazump the offer. Those buyers able to move quickly could crystallise the highest gains.