18 July 2016 - Analysis

Battersea/Nine Elms Riverlight 4 Scheme

Investors At Risk of Dropping Values in Nine Elms Scheme

Summary

When breaking down pricing data for Riverlight 4 scheme, July 2016 data suggests:

- Aasking prices only 18 percent higher than the average sold price in Land Registry.

- Average asking price of Riverlight 4 properties listed for sale is £1,300 per square foot.

- Average sold price, in Land Registry, was £1,100 price per square foot.

- Length of time properties are listed for sale implies average asking prices still too high to attract buyers.

- Indicators suggests period of illiquidity in the area.

- Recent penthouse apartment listed for sale 27 percent BELOW “market value” fails to attract buyer. “Market value” being defined as average asking price of currently listed properties.

- Penthouse apartment is one of a few units in Riverlight 4 to drop below critical £1,000 price per square foot asking price.

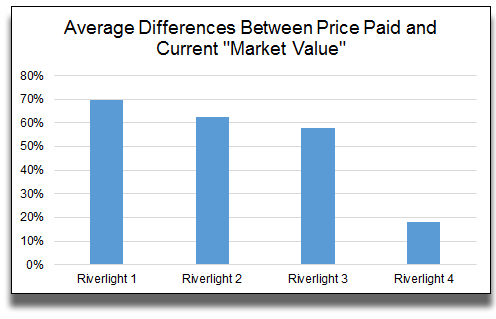

- Some investors in earlier Riverlight phases saw, on average, up to 70 percent increase in “market value”

- Many investors in Riverlight 4 and Riverlight 5 schemes could be near to breakeven point or below with tight margins

See also:

Jan 2017: Distressed Market Brings Underground Deals to Surface

Jan 2017: Resales Listed for Under Contract Price

Sept 2016: Tower Hamlets Price Pressure Caused by Surge in New Builds

July 2016: Could Reshaping Battersea/Nine Elms Spark Sales?

March 2016: Prices Drop in Battersea Power Station

Propcision Blog Entry: 5 Tips for Pitching Low Offers

Propcision: Research and Blog Postings

Latest Price Cuts Fail to Attract Buyers

Amidst increased tightening of the luxury housing market in Central London, investors in Battersea/Nine Elms regeneration area appear increasingly nervous as their off-plan completion dates draw near. The Riverlight 4 scheme in Nine Elms is the latest development to approach completion marking the beginning of the actual ownership of the units.

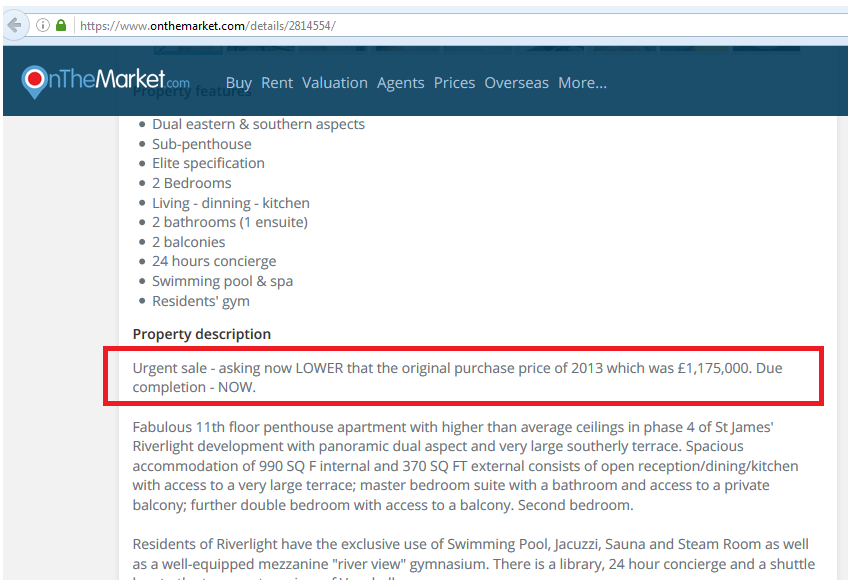

A somewhat “urgent” advertisement appeared on a property portal. An investor in the Riverlight 4 scheme is selling a "penthouse" below the original purchase price as the completion date nears.

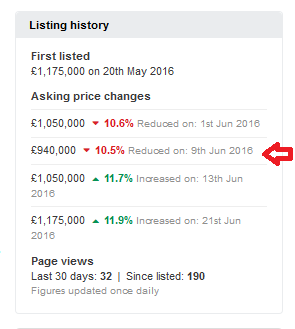

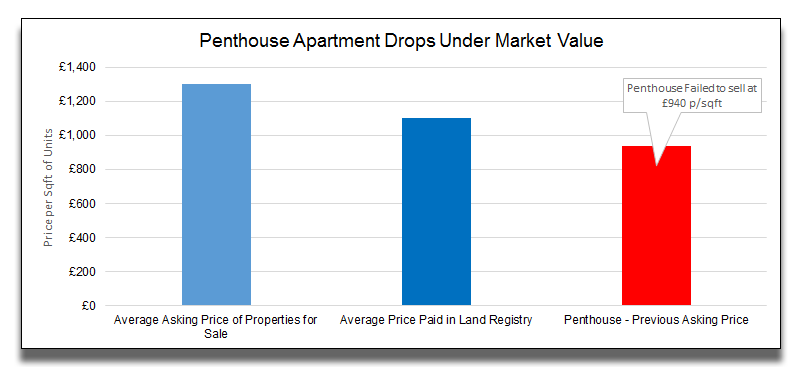

The advertisement implies that in 2013 the investor paid £1,175,000. We phoned an estate agent who also handles the listing. They confirmed that in mid-June, the price was briefly cut from £1,175,000 to £940,000 – making it less than the investor paid. Towards the end of June, the price was raised back to £1,175,000. It is now listed for £1,100,000. It was interesting to note that when the asking price was changed to £940,000 the unit failed to sell. This calculates to £950 per square foot –27 percent BELOW the average asking prices for units in this scheme.

Comparing Asking Against Sold Prices

Land Registry data for the Riverlight 4 scheme suggests investors paid between £540 to £2,284 per square foot for apartments. The average price paid being £1,100 per square foot. Bear in mind, the Land Registry data only shows data from 3 months ago thus there is not a complete picture as of yet. However, there were 124 Riverlight 4 apartments registered within the Land Registry thereby providing a seemingly broad sample of data.

Using Land Registry information for Riverlight, the price of the penthouse falls within the average price paid for units in Riverlight 4. That is to say, if the owner of the penthouse paid £1,175,000 then this equates to £1,186 per square foot. The average price of sold units in Land Registry was £1,100 per square foot.

However, the gap between sold and asking prices is quite narrow. Apartments appearing in the Land Registry are 18 percent below the average asking price of properties listed for sale (£1,1000 versus £1,300 per square foot). This suggests there is a small margin between price paid for the apartments and the current asking price of apartments for sale.

To add further pressure, the majority of apartments listed for sale appear to have been on the market for over 6 months to a year. This suggests that the asking prices are still too aggressive to attract buyers. Indicators also suggest a period of illiquidity in the area.

If investors are watching a penthouse apartment in Riverlight 4 scheme dip to 14 percent BELOW the average price of previously-sold units and 27 percent BELOW the average asking price of units currently listed sale yet failing to sell, it could certainly explain why some investors are becoming nervous.

Earlier Riverlight Phases Performed Better

Whilst data from the previous Riverlight phases 1, 2 and 3, suggests that investor returns were much healthier, it does appear that by the time phase 4 was being sold off-plan, prices were already pushed to the limit of what the area could support.

As the chart illustrates, earlier schemes clearly have the advantage as prices increased over time. On average, Riverlight 1 investors saw prices rise 70 percent more than the price upon completion. Asking prices of the later Riverlight 4 scheme are only 18 percent above the purchase price. This is treacherously close when factoring in slow activity in the scheme, aggressive asking prices, and evidence that pressure is mounting on current pricing.

With a very tight margin for Riverlight 4 investors, we may start to see more units listed for sale dipping below £1,000 per square foot. This will then be a strong indicator that prices have deteriorated from 2013 off-plan sales levels.

Riverlight 5 appears to be the last phase of the scheme. Whilst this phase is still under development with completion dates set for 2017, some investors are turning to auctions to shift property. If Riverlight 5 follows the same trend, indicators suggest negative values and/or tight margins for profit. If lack of liquidity persists, erosion of value could ensue. Early investors of phases 1 to 3 could be sufficiently insulated from price drops and have more room to negotiate pricing if they must sell.