Central London Luxury Properties Take Brunt of Price Cuts

London's high-value property prices slashed

18 May 2016

Eye popping amounts of cash are being slashed from the asking prices of high-value, Central London luxury properties. For example, a prime Central London property in Belgravia listed for £42.5 million has had 14pct reduced from its asking price since coming to market. This represents a whopping £6 million being wiped-out from its original valuation.

Price cuts on high worth homes can seem quite drastic when viewing them in terms of actual money, as the chart below illustrates.

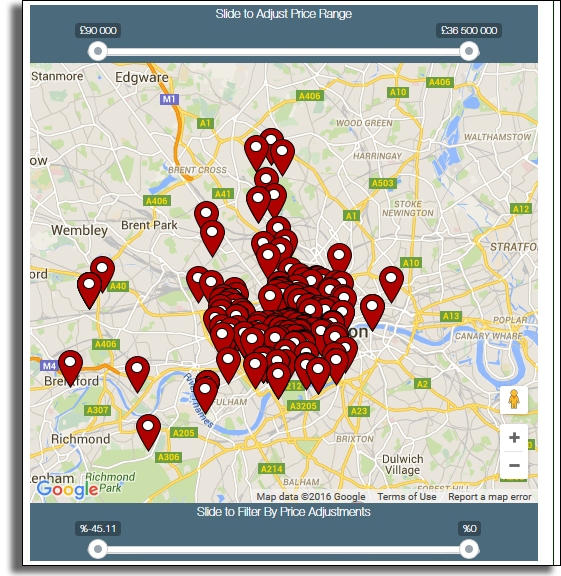

See Up-to-Date Interactive Map of London's Steepest Price Cuts

Top 10 Price Cuts by Cash Amount

Address |

Price |

Pct Reduced |

Monetary Amount Reduced |

London Borough |

Wilton Mews, London, SW1X |

£36,500,000 |

-14% |

-£6,000,000 |

WESTMINSTER |

Vicarage Gate, Kensington, London, W8 |

£19,500,000 |

-22% |

-£5,500,000 |

KENSINGTON AND CHELSEA |

Smith Square, London, SW1P |

£19,950,000 |

-20% |

-£5,050,000 |

WESTMINSTER |

Academy Gardens, Duchess of Bedfords Walk, South Kensington, W8 |

£26,000,000 |

-13% |

-£4,000,000 |

KENSINGTON AND CHELSEA |

Ennismore Gardens, London, SW7 |

£18,000,000 |

-18% |

-£4,000,000 |

WESTMINSTER |

Ebury Square, London, SW1W |

£13,500,000 |

-20% |

-£3,350,000 |

WESTMINSTER |

Cadogan Place, London |

£11,500,000 |

-19% |

-£2,750,000 |

KENSINGTON AND CHELSEA |

Winnington Road, Hampstead, London, N2 |

£9,500,000 |

-21% |

-£2,500,000 |

BARNET |

Connaught Place, Hyde Park, London, W2 |

£17,500,000 |

-13% |

-£2,500,000 |

WESTMINSTER |

Old Queen Street, St James's Park, London, SW1H |

£16,500,000 |

-13% |

-£2,500,000 |

WESTMINSTER |

When viewing reductions in terms of percentage of asking price, Central London properties represent the highest proportion of properties being reduced. Whilst the overall average price reduction in London appears to be between 5pct and 7pct, the bulk of steeper reductions of between 15pct to 20pct fall mostly on properties in Central London with most taking place in Westminster, Wandsworth, Kensington and Chelsea, Lambeth and Hammersmith and Fulham. Marketing history of the properties suggest a series of reductions over time. It may be that sellers initially priced the property ambitiously with hopes of an ever-increasing property market. These sellers may now have acclimated themselves to a changing-market strained under a combination of political and economic pressure alongside a series of changes in taxation

Interestingly, however, is that properties having the most drastic of reductions of upwards of 30pct cut from asking price are scattered across Greater London and not located in Central London. Data suggests that initial asking prices of these properties may have been too ambitious and prices were gradually adjusted downward to align with the market. Reductions of over 30pct are not common and only represent a small number of the total pool of properties having a reduction.

Whilst high value homes and Prime Central London property are being discounted, the more affordable homes in Greater London are remaining buoyant with some locations having experienced price increases.

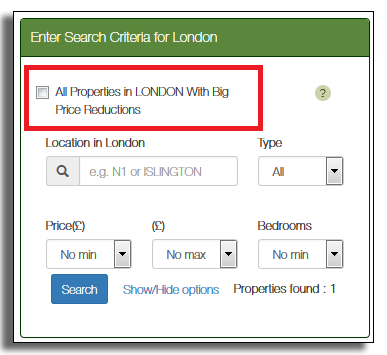

New tool helps to visualise property reductions across London.

To better visualise the asking price reductions throughout London, Propcision has introduced a new interactive tool called “London Sales Rack” http://propcision.com/investortools/salesrack/index.php

Users can click to bring back properties that have had the largest monetary amount cut from their asking price or pull back those properties with the sharpest percentage reductions.

The map will help to visualise where these cuts are taking place. It will be easy to spot the pattern of Central London luxury properties being most-affected by the recent slowdown.