10 March 2019

Flipping Florida

Turning to Overseas Property Markets for Buying and Selling

For less than a price of a new Fiat, Londoners can enjoy investing in the US.

Brexit has made an impact on the London property market as data illustrates the house prices continue to drop from 2015 highs. For investors, securing a property in a downward housing market means uncertainity that the property purchased today will be worth less tomorrow. Many investors are either sitting on the sidelines or looking abroad.

The movement of the financial industry from London to financial hubs within European Union 27 (EU27) jurisdictions continues to put pressure on the London property market whilst assisting to inflate values in Amsterdam, Frankfort, and Paris.

For those smaller investors, perhaps London was never an investment option due to the already high property prices and European housing markets are tricky to navigate.

Sophisticated housing tools such as Zillow give buyers a goldmine of housing information. No longer do buyers need to be on-the-ground when purchasing a property.

Online Tools Offer Transparency

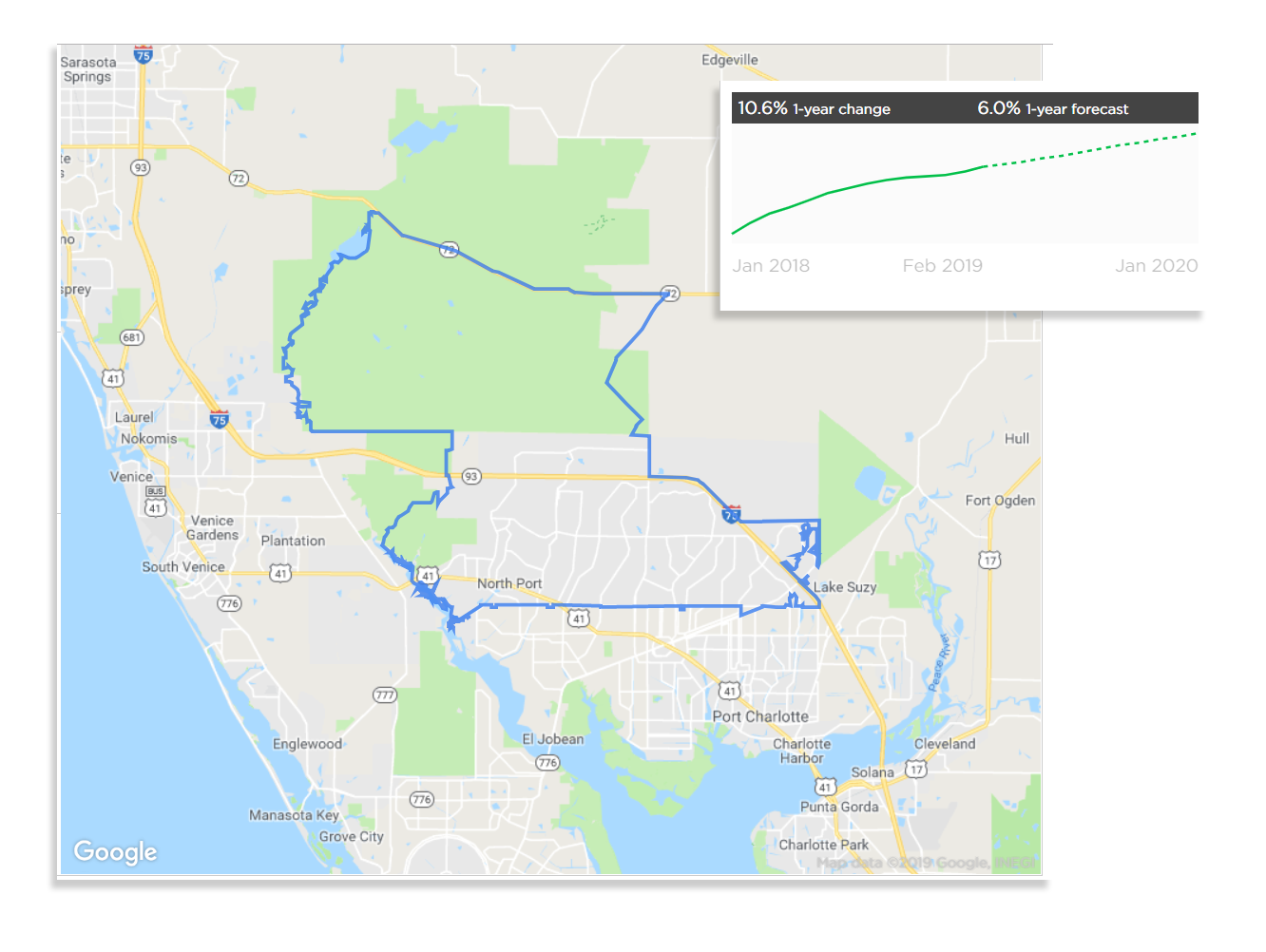

Recently, I decided to research property data for North Port, Florida as I am looking to sell a buildable house lot.

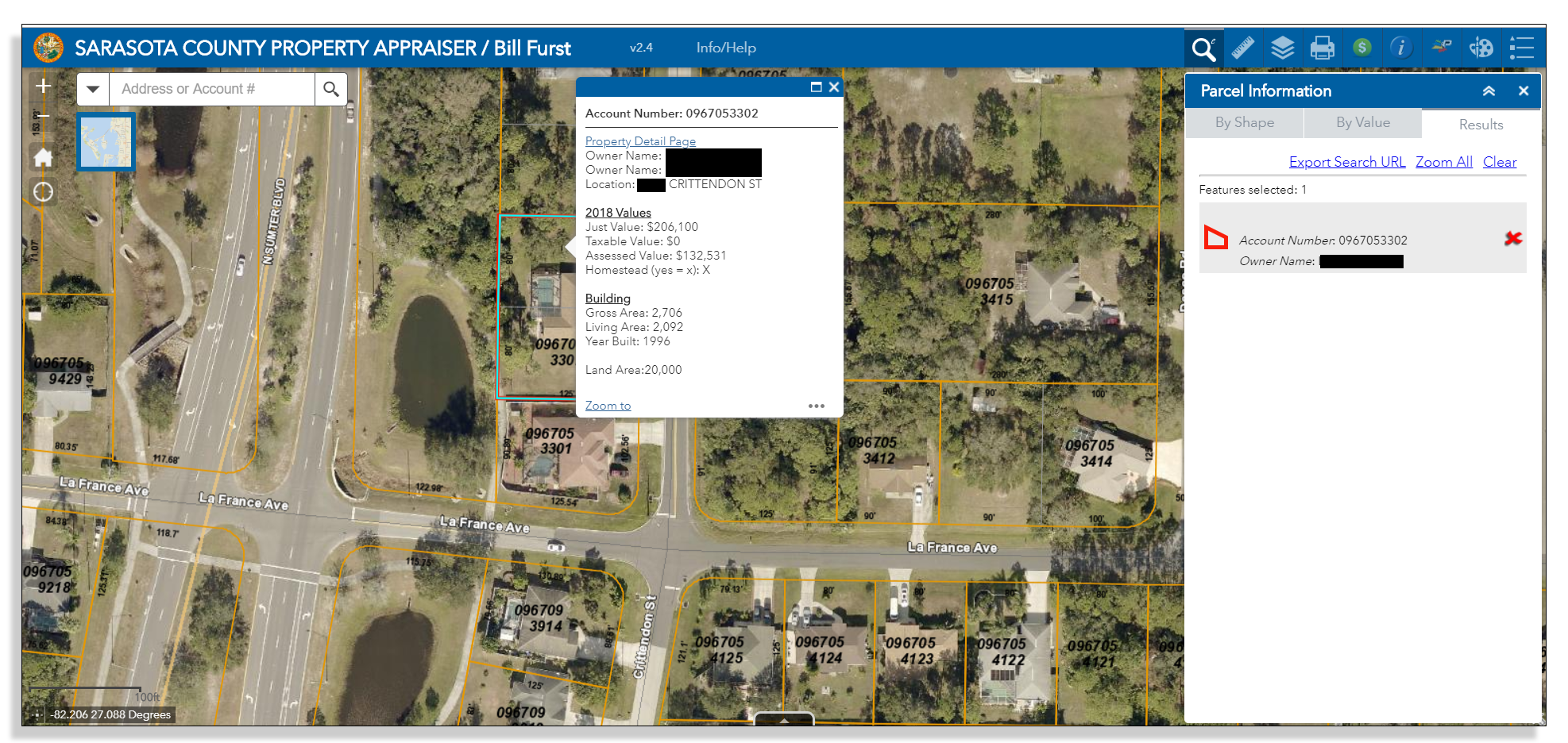

Using free online tools from Sarasota County,Florida (the county in which North Port resides) I could easily produce a graph illustrating the valuation on my parcel of land in North Port over the last 10 years. Unsurprisingly, the data illustrates a peak in value of my lot at the height of the housing bubble in 2009. Then, the valuation of the land drops rapidly hitting a low in 2013. Since then it has reliably inched its way back up.

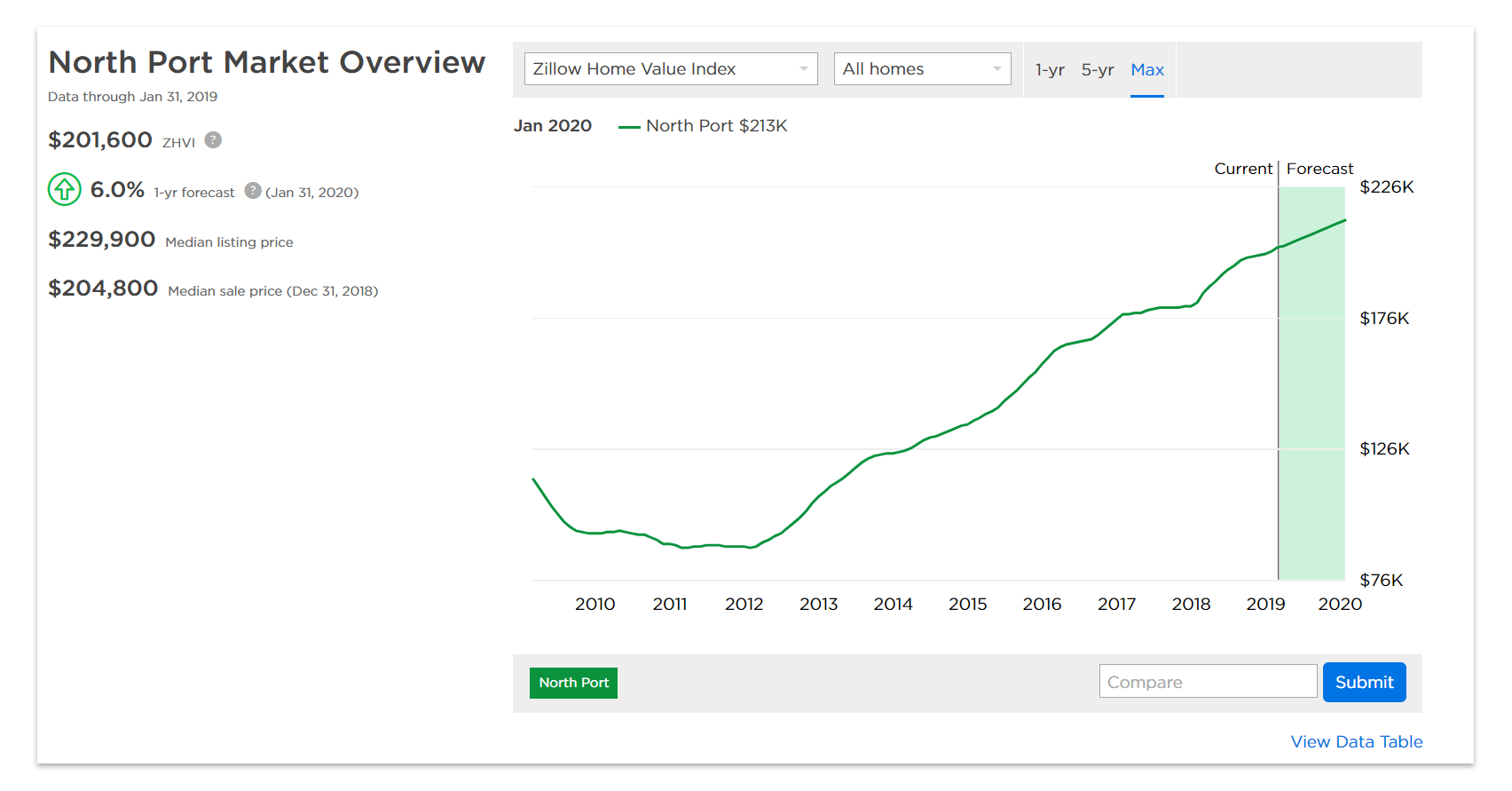

I then used another website Zillow to view data related to the overall buoyancy of the North Port Florida housing market. It was comforting to see a graph pointing upwards with the value of the land expected to increase by 6pct this year.

Computing Fair Market Value

As I was computing a fair market value for the lot, I used a variety of tools available online and discovered they were far more sophisticated than those available in the UK. Impressive to see data transparency in home ownership, taxes, land and property value, and housing data.

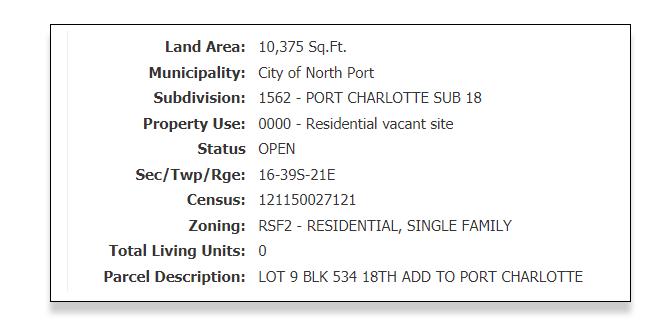

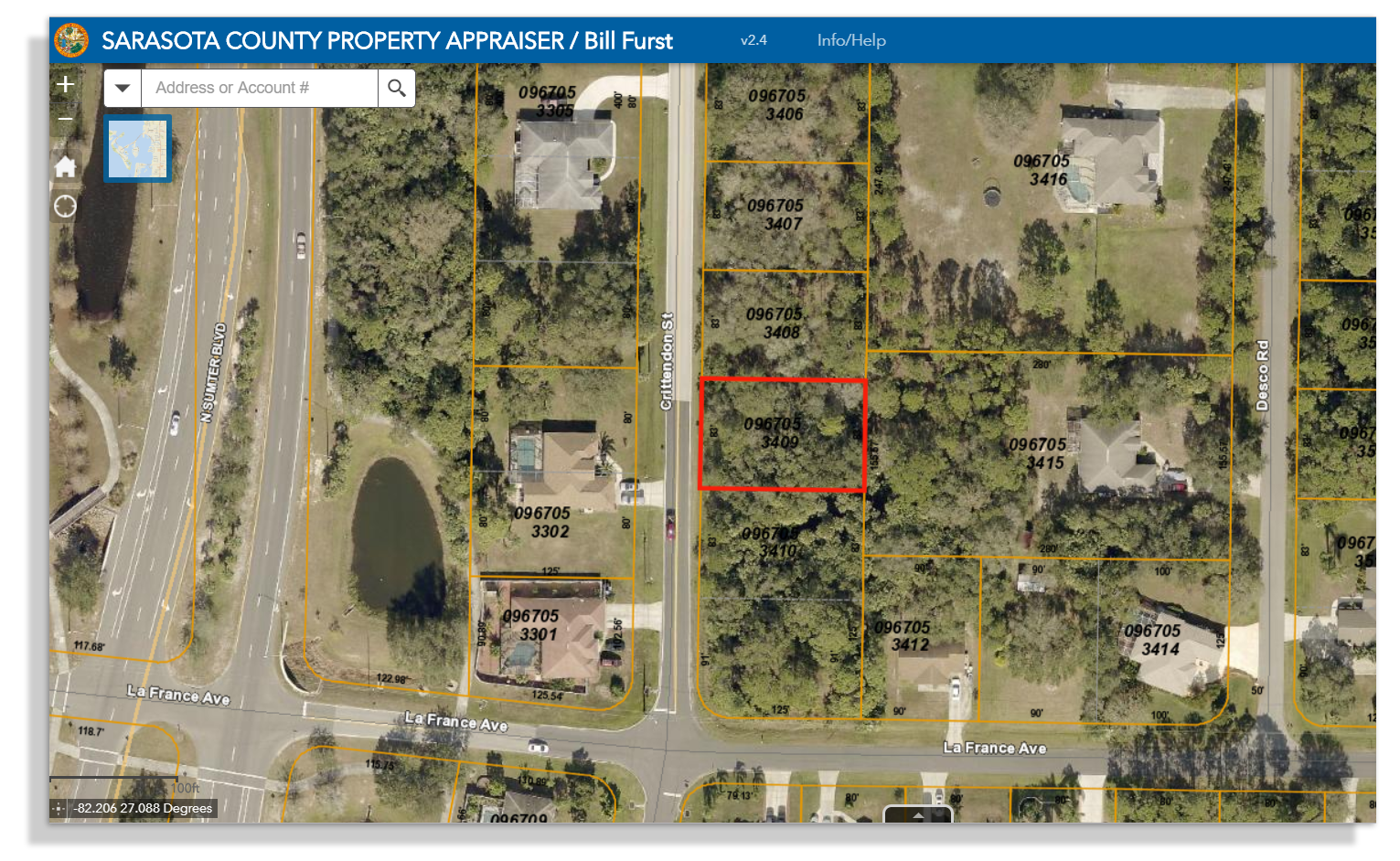

The plot I am listing for sale is a 10,375 square foot buildable lot suitable for a large single-family dwelling in North Port, Florida, USA. Given that a prospective buyer can also purchase the adjacent lot that is also for sale (by a relative) it was thought that this parcel of land has inheritant value and could offer buyers options.

With taxes only $300 per year for a plot of land in North Port Florida, the cost of ownership is relatively low. I suspect this made Florida even more desirable as opposed to elsewhere in the US.

Sophisticated housing tools such as Zillow give buyers a goldmine of housing information. No longer do buyers need to be on-the-ground when purchasing a property.

Discovering what the neighbors property is worth. Click through to see all house and land valuations.

Target prospective purchases using free tools offered by local municipalities such as Sarasota, Florida, Property Appraiser Tools. This tool shows last valuation details so that prospective property developers can form predictions about expected house values if they develop land nearby.

Amazing What $9,000 (£7,000 GBP) Can Buy!

Using the online tools, I could easily compute the median house price for exact area of my lot was $200,000 US dollars which is smack in the sweet spot of affordability for most people in the area. This added an element of desirability to the lot as small, local homebuilders could economically build a house on the plot and walk away with a tidy profit.

After conducting research, I decided to list my property at $9,000 (£7,000 GBP). Then, it occurred to me that for the less than the price of a FIAT panda, someone can own a parcel of land.

Given that a new Fiat Panda, loses half its value shortly after pulling out of the dealership, a parcel of Florida land seems like a reasonably good investment - either for short-term or long-term growth.

Seeing What the Neighbors Are Getting Up To

With new regulation in the EU, such as GDPR, protecting personal data and its usage are recognised, does the US go too far in allowing unfettered access to individual's economic data?