Depressed Market Brings Underground Deals to the Surface

13 January 2017

A stone’s throw from the fashionable Sloane Square sits a well-presented flat priced at £1m. Anyone who knows Sloane Square will quickly recognise this is a steal as, by right, the flat should be listed at £1.6m. So why is this flat 37 percent cheaper and still on the market? It’s located on the lower-ground floor.

In many areas of Prime Central London, the pricing gap between upper and lower floors has widened. In the past, the price-per-square-foot difference between a lower ground/basement and an upper level flat was typically between 15-20 percent. Now, the price difference, on average, has widened by a further 5 percent. Furthermore, in some locations, it has become increasingly common to see larger, lower-ground floor properties with no outdoor space listed at over 30 percent less than their upper-floor counterparts.

This means that some lower-ground floor properties are listed at the same “price-per-square-foot” as many areas outside of the Prime Central London perimeter. For buyers seeking location, this could be the time to look at basement and lower-level flats.

Amongst London boroughs, Kensington and Chelsea and Westminster were the two boroughs having the greatest pricing difference between upper and lower-ground floors.

Historically, restricted views, ground-level noise, reduced light, temperature, and “buyer preference” all affect marketability of lower ground floors. Recently, the price gap may have widened due to sellers competing for the attention of a smaller pool of buyers. A buyers’ market may mean buyers are looking for their perfect property. There may be less “compromising” and more “haggling”.

For larger lower ground floor apartments, above 1,000 square feet, “pricing thresholds” may be at play. At a certain price, buyers start to rationalise that instead of buying a large, lower ground floor flat, they could spend the same money on a smaller, upper-floor property or a property in a different location.

With London underground routes running across Central London, some lower ground floors are justifiably cheaper due to these noise conditions. Dorset Square in Marylebone, Stanhope Gardens in Kensington, and Queens Gate in South Kensington are specific areas where the train lines may be faintly heard underneath. However, properties affected by train lines only account for a fraction of lower ground properties on the market.

Overall, in London, 2.5-3 percent of properties listed for sale are located on a lower ground floor. When looking at just Central London boroughs, the figure rises to approximately 6.5 percent of properties for sale being set on lower ground floor.

Mayfair And Fitzrovia

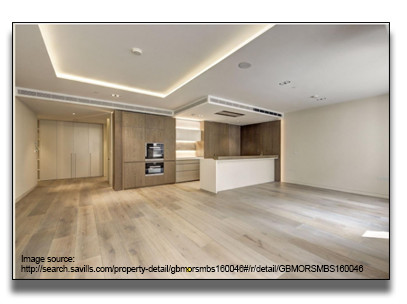

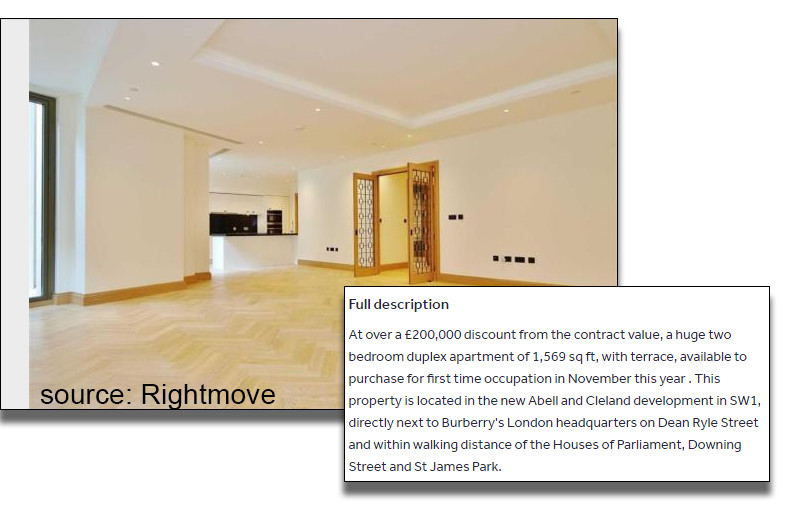

New build apartments in the same development offer a like-for-like comparison.

In the heart of Mayfair, a large lower ground flat recently came to market in November for £3.8m - roughly 45 percent cheaper than its upper-floor counterparts. Had the same flat been located on an upper-floor, then it would have been listed at upwards of £6m.

A new build property adjacent to Fitzroy Square in trendy Fitzrovia in Westminster is another great example. A large ground and lower ground floor duplex is listed for £2,495,000 which is £1,133 per square foot. Data suggests this is 46 percent cheaper than similarly-sized properties, on upper floors, within the same area. Listed since October, it has already been reduced by 12 percent.

Just down the street, at Fitzroy Place in Westminster, another newly-built lower ground and ground floor flat is listed for sale at £2,100,000 or £1,429 per square foot. Data suggests that this flat is 35 percent cheaper than upper level flats in the same new-build development. In both cases, the pricing threshold may be at play as sellers need to lure buyers with exceptional value.

All are fantastic apartments with high, quality finishes. They are considerably “larger flats” in terms of space therefore, a “pricing threshold” may have come into play. Buyers may be weighing-up “more space” versus a “less sunlight” – thereby opting to haggle for discounts on an upper floor rather than settle on a lower level.

Swap "Views of the City" for "the City"

When looking at the price per square foot, these properties are cheaper than some new builds outside of Prime Central London. Buyers are paying more for new-builds in areas of Aldgate, Islington, Battersea, and Canary Wharf - to name a few.

In the City of London, near the bank of the River Thames, sits a newly-renovated large 3-bedroom, lower ground and ground duplex listed for £1,500,000 or £794 per square foot. The positioning alone of this desirable area could command a hefty rental income as professionals in the City seek location and convenience. The trendy nature of the flat will also be an attractive factor in securing a rental yielding more than 3 percent.

Rental Yields

Lower ground floor properties could be an attractive investment for investors mining for value in terms of capital growth and rental yield. Rental yields for lower ground floor flats tend to be higher than upper floors whilst capital growth generally follows the housing index in the area. Therefore, if buyers return to the Prime Central London housing market, then, theoretically, the gap between the pricing of lower ground and upper floor flats may narrow and fall back into line with historical price gaps. This means, investors capitalising on the gap now may potentially realise a greater capital growth if the gap narrows.

As with the financial market, the housing market experiences trends. Pricing gaps widen and narrow with specific market behaviour. Get the timing right and it could pay off.